|

|

Case Studies

This expected value analysis case study [real world,

sanitized model] is of a single oncology drug [product]

targeted for multiple late-stage cancers. The product

is in different phases for each indication, therefore the

probability of a positive outcome changes from one

indication to another; obviously a Phase III trial has a

greater likelihood of success, becoming a marketed product,

than does a Phase II trial for the same drug. In

addition, decision tree modeling of expected value looks at

the abandonment option; the option to abandon the project if

performance in unsatisfactory [i.e. a clinical trial goes

bad]. Other options are also modeled and include the

option to switch inputs or outputs, option to delay, option

to build, option to partner or option to grow.

Simple NPV weighting based on expected

probability of positive outcome:

-

'Expected probability of success' is

determined by empirical data and expert opinion.

-

'Non-weighted NPV' is what the product

specific / indication specific model values the product

at.

-

'Weighted or expected NPV' is the

adjusted NPV based on the 'expected probability of

success'.

|

Indication |

Phase |

Expected prob.

of success |

Non-weighted NPV [$000] |

Weighted or expected NPV [$000] |

|

|

Cancer 1 |

IV |

80% |

$360,000 |

$288,000 |

|

|

Cancer 2 |

II |

15% |

$140,000 |

$21,000 |

|

|

Cancer 3 |

III |

45% |

$470,000 |

$211,500 |

|

|

|

|

Totals: |

$970,000 |

$520,500 |

Expected value |

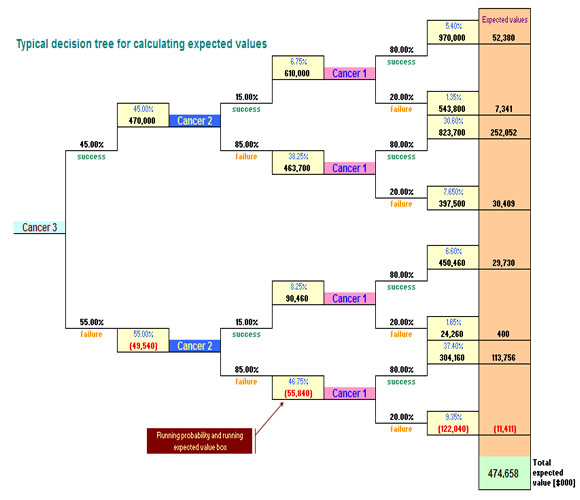

Decision tree modeling:

Decision tree modeling allows for

completely transparent and detailed visualization of the

expected value analysis. As you can see from the

decision tree below, running probabilities and running

expected NPVs are carried forward along all permutations

of each decision branch. The positive values are

obvious and given in the matrix above, in the

'Non-weighted NPV' column. The negative values

[abandonment options] are

derived within the product model itself and represent

certain amounts of sunk costs if parts of the project

were to fail along the way. The total expected

value for this project is $474,658 [000]. This

value is 8.8% smaller than our expected value in the

simple 'Weighted or expected NPV' analysis. The

difference can be explained in the fact that the

decision tree model utilizes the potential losses

whereas the matrix above does not. In addition,

the decision tree accounts for more variables and may be

considered a more accurate analysis in light of the

abandonment option at any node.

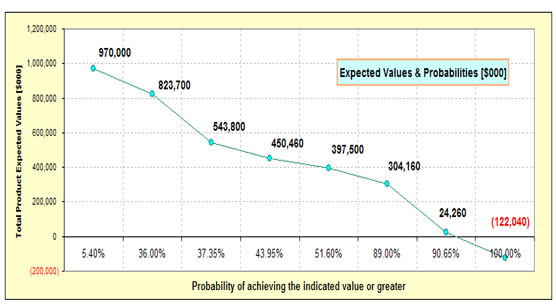

The chart below is representative of

expected values versus probabilities. For

instance, this project has a 51.60% probability of

having an NPV of $397,500 [000] or greater. This

chart has an x-intercept of 92.55%, taken directly from

the model. Effectively, the project has a 92.55%

probability of at least breaking even.

This expected value analysis is only a

very small portion of an entire financial modeling

system where a change in a seemingly unrelated part of

the model will propagate throughout modeling system.

This is a very powerful attribute of the SG Systems'

models. Particularly when during the midst of an

important presentation and a 'what if' question is

asked. You can simply make the change on-the-fly

and have the model updated in seconds.

Expected value analysis can be used on

single product, single application projects or on

multi-dimensional products spanning multiple product

lines and is not limited to pharmaceutical or

biotechnology industries.

Contact SG Systems for more information or to

arrange a consultation.

|