|

Case Studies

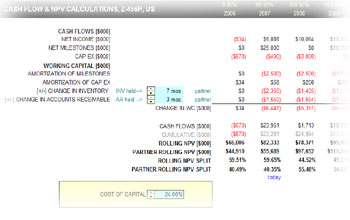

This cash flow model case study is based on a real world,

but sanitized financial valuation of a patented, early stage

pharmaceutical oncology drug cocktail.

The cash flow model itself is relatively

simple. The innovation comes in the understanding and

modeling of future events in an accurate and user friendly

manner. The results of the cash flow analysis is a

realization of the capitalization requirements of the

venture, the potential profitability of the firm, and

valuation of the company today and in the future. In

addition, we can readily see what the licensing and

partnering effects of a deal might be and what items are

most sensitive to changing the balance of an agreement.

We talk more about deal terms and deal structuring in our

Licensing and

Partnering page.

The basics of the cash flow model require

that we start with our net income, which is derived from the

end of our expense

model. We then add back

amortized and depreciated receipts or payments. The

next step is to rectify all of the

non-cash items such as the amortization and depreciation

values that were used to determine our net income.

We also need to account for other

working capital items such as change in current assets [i.e.

inventory] and current liabilities [i.e. accounts

receivable]. We finally sum the working capital

requirements with the net income and amortized and

depreciated receipts or payments to get the cash flows over

time.

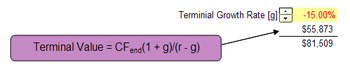

Once

we establish our cash flows we need to derive a terminal

value to accurately value the product. This is simply

illustrated in a formula in the image on the right where 'CFend'

is the final cash flow of our model, 'g' is the terminal

growth rate, and 'r' is our cost of capital. Of

course, expert opinion has a great deal of impact on the

terminal growth rate and depends on what stage the product

is in. If the model ends while the product is in the

growth stage, the terminal growth rate will probably be a

positive value. Respectively, if the model ends during

product maturity or decline, the growth rate could be flat

to negative. Once

we establish our cash flows we need to derive a terminal

value to accurately value the product. This is simply

illustrated in a formula in the image on the right where 'CFend'

is the final cash flow of our model, 'g' is the terminal

growth rate, and 'r' is our cost of capital. Of

course, expert opinion has a great deal of impact on the

terminal growth rate and depends on what stage the product

is in. If the model ends while the product is in the

growth stage, the terminal growth rate will probably be a

positive value. Respectively, if the model ends during

product maturity or decline, the growth rate could be flat

to negative.

A simple cumulative sum of expected cash

flows will determine the capitalization requirements of the

firm and is an invaluable tool when working on garnering

additional funding.

We can finally calculate our NPVs over time.

This is a good way to illustrate how the value of the firm

varies over time and can help target a time frame where the

value of the product is at a maximum.

|