|

Case Studies

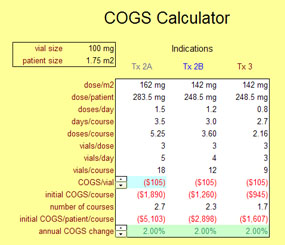

This expense model case study is based on a mid-stage,

patented oncology drug cocktail [real world, sanitized

data]. The expense model will get us to the expected

net income of the product and from there we can move forward

with calculating our expected cash flows, terminal values,

and net present values.

Once

we have a sound revenue model in place

we can move forward with the integration of the expense

model and two of the first issues we deal with is 'Returns,

Discounts & Allowances' and 'COGS'. The line item

'Returns, Discounts & Allowances' can be a simple percentage

of total revenues or raw data whose genesis is from expert

opinion, empirical data, or sales force estimates.

COGS, on the other hand, is typically a calculated value

that changes with time. Generally, we build a COGS

calculator to keep the values as transparent as possible.

Many of the inputs come from our

revenue model

while other data originate directly from manufacturing firms

and expert opinion. Once

we have a sound revenue model in place

we can move forward with the integration of the expense

model and two of the first issues we deal with is 'Returns,

Discounts & Allowances' and 'COGS'. The line item

'Returns, Discounts & Allowances' can be a simple percentage

of total revenues or raw data whose genesis is from expert

opinion, empirical data, or sales force estimates.

COGS, on the other hand, is typically a calculated value

that changes with time. Generally, we build a COGS

calculator to keep the values as transparent as possible.

Many of the inputs come from our

revenue model

while other data originate directly from manufacturing firms

and expert opinion.

After the COGS are derived and applied, we

begin to develop our partnering and licensing section.

Upfront payments, milestone payments and schedule, and

royalty rates are defined and calculated. Please see

our Licensing and

Partnering page for more details on deal term modeling.

We then account for capital expenditures and

depreciate these costs accordingly, later, in the net income

section of the expense model and in the

cash flow model.

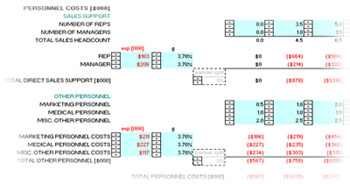

Personnel

costs have a unique aspect to them; they are truly dependent

on regional pay rates. For instance, a sales

representative in one region may expect a totally different

compensation package than a sales representative in a

different region. And, of course, the total cost for

these different compensation packages will not be equal.

Personnel costs make up a significant portion of the overall

expense associated with a specific product. Therefore

it is critically important that these costs are accurately

modeled. Otherwise there exists the potential to

either dangerously underestimate the total expenses and

thereby under fund the capitalization requirements of the

project or to frivolously overestimate Personnel

costs have a unique aspect to them; they are truly dependent

on regional pay rates. For instance, a sales

representative in one region may expect a totally different

compensation package than a sales representative in a

different region. And, of course, the total cost for

these different compensation packages will not be equal.

Personnel costs make up a significant portion of the overall

expense associated with a specific product. Therefore

it is critically important that these costs are accurately

modeled. Otherwise there exists the potential to

either dangerously underestimate the total expenses and

thereby under fund the capitalization requirements of the

project or to frivolously overestimate

the

total expenses and scare away potential investors by

reflecting narrower profit margins. the

total expenses and scare away potential investors by

reflecting narrower profit margins.

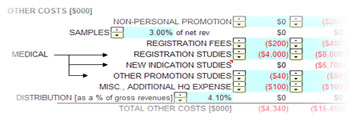

Other costs are the remaining expenses that

need to be modeled. Promotional expenses, drug sample

costs, an array of medical fees and expenses, product

directed headquarters' costs, and product distribution are

part of this case study. There are any number of

additional expenses that other projects will require.

Some of these items are simple, non-calculated vales, while

others are calculated by dependent functions.

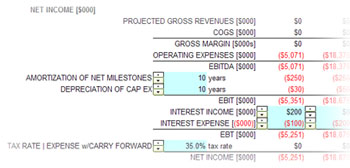

Once

we have compiled all of our projected expenses and projected

revenues over a time period ranging from a few months to a

few decades, we can begin to calculate our pro forma net

income. The reporting of net income values occurs at

the intervals that were used for the other projected values.

The intervals can be any time period but are usually in

years. Often the models will have shorter reporting

periods of quarters or months when dealing with a marketed

product. It is at this point where the non-cash items

such as 'Amortization of Net Milestones' [see

Licensing and

Partnering for more details] and 'Depreciation of

Capital Expenditures' are factored into our net income

calculation. Our 'Tax Expense' is calculated here

using an SG Systems custom macro which accurately determines

the tax benefit of loss carry forward. This is a

particularly important aspect of financial modeling because

the carry forward effect has a direct effect on the future

cash flows and could possibly have significant impact on the

project capitalization requirements. Once

we have compiled all of our projected expenses and projected

revenues over a time period ranging from a few months to a

few decades, we can begin to calculate our pro forma net

income. The reporting of net income values occurs at

the intervals that were used for the other projected values.

The intervals can be any time period but are usually in

years. Often the models will have shorter reporting

periods of quarters or months when dealing with a marketed

product. It is at this point where the non-cash items

such as 'Amortization of Net Milestones' [see

Licensing and

Partnering for more details] and 'Depreciation of

Capital Expenditures' are factored into our net income

calculation. Our 'Tax Expense' is calculated here

using an SG Systems custom macro which accurately determines

the tax benefit of loss carry forward. This is a

particularly important aspect of financial modeling because

the carry forward effect has a direct effect on the future

cash flows and could possibly have significant impact on the

project capitalization requirements.

Now that we have the pro forma net income

statement developed, we can build the

cash flow model

where we will gat a much better picture of what the value of

the project is in today's dollars.

|