|

Case Studies

This pharmaceutical revenue model case study is an aggregate of three

different chemotherapy products [real world, sanitized

data].

Once we have a robust

market model in place

and we have a good level of confidence in its projections,

we can begin to develop the revenue model. In the case

of pharmaceutical products, if the product being analyzed is

in early stage development, we may not know the dosing

schedule, amounts of the doses, or even the drug delivery

method. In these early stage cases we need to build a

flexible dosage and pricing calculator.

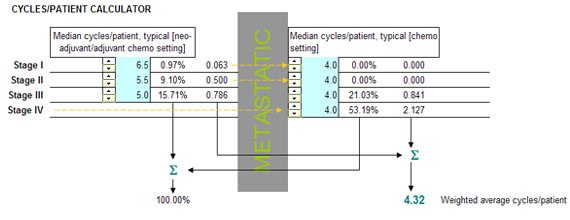

Below is an example of a cycles/cancer

patient calculator. In this case the product that we

analyzed had a targeted label for metastatic usage but may

garner some progressing patients [stage III to stage IV]

that needed to be accounted for and may actually receive

approval for earlier stage indications. Our calculator

tells us that weighted average cycles/patient is about

four-and-a-third.

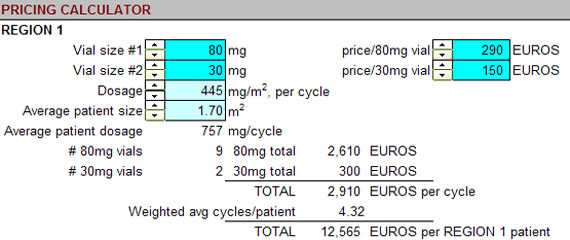

Our next step is to unearth what kind of

revenues we would expect from a typical patient. This

step can get rather complex as we need to investigate our

method of drug delivery, the manufacturing protocols,

recommended dosage based on any number of criteria, and

expected pricing structure. Specifically, in the case,

you can see that we are manufacturing two different vial

sizes of the drug [80mg & 30mg]. Based on clinical

research and the expected indications approved we have a

dosage of 445 mg/square meter of body size per cycle.

The average body size in the region we have targeted is

approximately 1.70 meters squared. The calculator

returns the average patient dosage per cycle as 757 mg which

equates to nine 80 mg vials and two 30 mg vials of drug.

We have set the prices of the 80 mg and 30 mg vials at

290 EUROS and 150 EUROS, respectively.

We already calculated the weighted average cycles/patient at

4.32. We get our expected revenue per patient at 12,565

EUROS in this region.

The calculated revenue per patient is a

starting number. We now need to project revenue

changes over time due to competitive market forces, price

erosion or price premium adjustments, patent expirations and

the market entry of generics, and economies of scale.

Once we hammer out these effects on revenue, we can finish

the revenue model and have a high degree of confidence that

we are on the right track and can begin to integrate our

projected revenues into our

expense model.

|