|

Methods

SG Systems works hand-in-hand with the client's in-house or

consulting experts to develop extraordinarily robust,

user-friendly, and transparent valuation models.

Market Model

Our first effort is to develop a market model.

This begins by working with the product developers to

determine the end-users' profiles. For pharmaceutical

products this often revolves around the targeted indications

and expected drug label. Then epidemiology data is

compiled and extrapolated and winnowed down. Incidence

and prevalence rates are layered, if necessary. Distribution

channels and market access are areas that require

close scrutiny. The aforementioned items along with a

variety of other variables help us derive our realistic

market model. Our first effort is to develop a market model.

This begins by working with the product developers to

determine the end-users' profiles. For pharmaceutical

products this often revolves around the targeted indications

and expected drug label. Then epidemiology data is

compiled and extrapolated and winnowed down. Incidence

and prevalence rates are layered, if necessary. Distribution

channels and market access are areas that require

close scrutiny. The aforementioned items along with a

variety of other variables help us derive our realistic

market model.

For more details see Case Study: Market Model

Revenue Model

Once we have a robust market model we need to determine how

much market share the product can command. Market

share not only depends on how 'great' the product is, but

how much 'greater' it is in comparison to marketed

competitive products, how much it costs in relation to these

other products, when and if the product comes off patent

protection, and many other factors which are all

interrelated. It is the accurate modeling of all of

the interrelated variables that creates a viable revenue

model.

For more details see

Case Study: Revenue

Model

Expense Model

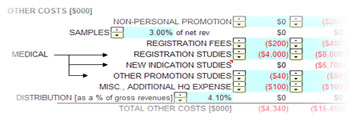

OK, so now you have a good feel for how much revenue the

product can turn in the expected market. Now we need

to build up the associated expense model. This is

often the most complex portion of the total product or

project valuation. Many variables enter the fray and

are often interdependent on each other in regards to

magnitude. Cost of Goods Sold [COGS] is certainly a

Variable Cost [VC] and is directly dependent on the amount

of expected product sales. Whereas Clinical Trials

[CTs] are more or less considered to be a Fixed Cost [FC]

for the project. The handling and calculating of the

myriad of expenses is a crucial step in the valuation

process. Make a mistake here and you could either

severely underestimate the required capitalization or pinch

the projected profit margins and lose investors. OK, so now you have a good feel for how much revenue the

product can turn in the expected market. Now we need

to build up the associated expense model. This is

often the most complex portion of the total product or

project valuation. Many variables enter the fray and

are often interdependent on each other in regards to

magnitude. Cost of Goods Sold [COGS] is certainly a

Variable Cost [VC] and is directly dependent on the amount

of expected product sales. Whereas Clinical Trials

[CTs] are more or less considered to be a Fixed Cost [FC]

for the project. The handling and calculating of the

myriad of expenses is a crucial step in the valuation

process. Make a mistake here and you could either

severely underestimate the required capitalization or pinch

the projected profit margins and lose investors.

For more details see

Case Study: Expense

Model

Deal Terms / Licensing & Partnering

Many major trade-off decisions, for example licensing versus

in-house product distribution, are made within the expense

model. Deal terms are ironed out within the expense model. When should milestones be paid? How much should each

of those milestones be? What, if any, upfront payments

should be made? If licensing, what are the

various royalty rates and thresholds? These are very

critical items that need to be modeled in a very accurate,

transparent, and easy to use form. Otherwise do you

really know the cards that you can play when making a deal?

The more information at your disposal that is clear, easy to

understand, and relevant will provide you with a significant

level of competitive advantage. And if you don't have

this competitive advantage, your 'partner' certainly will.

See our Licensing

and Partnering page for more details.

Cash Flow Model

The cash flow model is often times placed at the tail end of

the expense model or sometimes built up as a separate

entity. It is in the cash flow model where we

essentially determine taxable income, the overall tax effect

of the product with all of the carry-forward tax benefits,

net income, the overall cash flow, capitalization

requirements, terminal values, and finally a Net Present

Value [NPV] of the project. All of the milestones,

paid out or received, need to be accounted for by adding

back or subtracting out the amortized milestones along with

other non-cash items [i.e. CapEx]. In addition, the

working capital items such as 'inventory held' and 'accounts

receivable' need to be accounted for.

We also build in a NPV Split to determine whether or not the

deal is fair to both you and your partner. The NPV

Split essentially is a build up of the partner's expected

revenues versus expected expenses. Much of the partner

information derived empirically or by other means.

See our Licensing

and Partnering page for more details.

|

If you know

the enemy and know yourself, you need not fear

the result of a hundred battles. --

SunTzu |

|